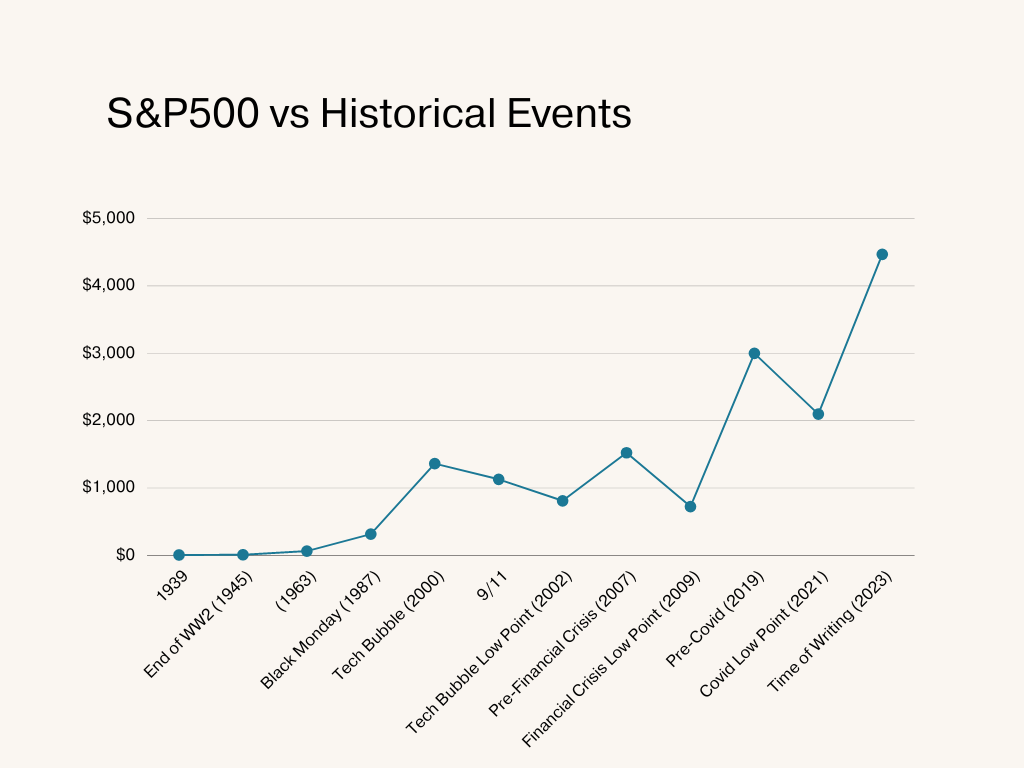

While crafting investment portfolios, we painstakingly pore over the daily, weekly, and monthly charts that detail the tumultuous journey of the markets. These charts often reveal startling dips and surges that sometimes appear without rhyme or reason – we truly cannot know how the markets will behave tomorrow. But when we pull back, a pattern begins to materialize – ‘up and to the right,’ or, perhaps more eloquently, ‘Market Resilience.’ This resilience forms the underlying current of the market, a comforting constant even during the most chaotic times.

Let’s look at the market today as an example. At the time of writing, the S&P500 is worth $4,467.71 and dropping. Nerves are getting rattled; some investors may even sell before it goes down even further. But reflecting on the historical resilience we’ve just explored, we’ve got to ask: Is that the right thing to do?” Let’s look back in time.

In November 2019, the S&P500 reached the $3,000 mark with Covid right around the corner. At the peak of turmoil caused by the pandemic, the S&P sunk to about $2,100 in March of 2020 – just for it to shoot past $3,000 again in July, never to drop down past that point again – so far.

These kinds of market shocks happen repeatedly, and the markets always recover with enough time and patience, as shown in the chart below.

These historical patterns naturally lead to the question: Is reacting to these market fluctuations by buying and selling at the perceived “right” times a wise strategy? The evidence suggests otherwise.

The Perils of Timing the Market

Many investors buy when markets are rising, then sell when the markets start falling. The problem is, we never know when they’ll start falling or rising and by how much. So, let’s create some scenarios where an investor buys and sells based on their hunch.

Investor A starts investing $10,000 annually into the S&P 500 from 1999 to 2019 but always puts his money at a yearly peak. Surprisingly, this “unlucky” approach still yields an annual return of 6.91%. Not bad!

Investor B utilizes the same approach but happens to buy at each year’s low and ends up with an annual return of 9.16%. That’s a solid investment return, but Investor B was lucky.

Now, let’s be realistic. Neither being the luckiest nor unluckiest investor over that 20-year period is likely. So, let’s settle on a decent average annual return of around 7.5%.

Now, these are investors who stay invested, meaning they don’t sell, they just hold. But what would happen if they tried to time the market and consistently bought and sold assets? They’d miss some of the best days in the market – and missing those best days is much worse for your portfolio than consistently buying high and selling.

Case in point.

Investor C is a vagabond investor who likes to regularly buy and sell. He invests in the volatile period beginning on January 1st, 2009. If he holds that $1,000 investment in the S&P 500 for a decade, he would have $2,775 within ten years. But Investor C is impatient, and through buying and selling, he misses ten of the best days in the market, cutting his return to $1,722.

It only gets worse from there. If he misses 20 days? He’ll only end up with $1,228. Misses 30? He’s actually losing money, ending with a measly $918. And missing 40 of the best days will leave him with a paltry $712. After factoring in inflation and lower purchasing power, that’s a pretty hefty loss.

The lesson here is stark but valuable: whether investing at market highs or lows, consistent investment can lead to solid returns. However, trying to time the market can lead to significant losses. The market is unpredictable, and the risk of missing those crucial days can turn a promising investment bleak very quickly.

So we know timing the market doesn’t work. Buying and holding is the clear winner, but you may find yourself looking for even greater portfolio stability than what dollar-cost averaging offers. One such strategy that has stood the test of time and volatility is the incorporation of dividends.

The Role of Dividends

Dividends are more than just a steady income stream for investors; they often act as a stabilizing force during turbulent market conditions. When the value of stocks may be falling, dividends continue to provide returns, adding a layer of security and reassurance.

What Are Dividends?

Dividends are portions of a company’s profits that are distributed to shareholders, usually on a quarterly or annual basis. They represent a tangible commitment by the company to share its success with those who have invested in its growth.

Reinvestment Opportunities

Investors can choose to reinvest dividends into buying more shares, often at lower prices during a down market, which can lead to compound growth when the market rebounds.

Indicator of Financial Health

Companies that consistently pay dividends are often seen as financially stable. During uncertain times, these dividends can be a sign of underlying strength, providing investors confidence in their long-term strategy.

Dividends are not a guarantee against loss, nor are they a cure for all market ills. However, they have historically played a valuable role in mitigating the impact of market shocks.

Lessons for the Modern Investor

Investing in the financial markets is a journey filled with uncertainties, opportunities, and invaluable lessons. The historical analysis of market trends and the stabilizing effect of dividends offer insights that can be applied to modern investment strategies.

The Importance of Staying Invested

As illustrated in our examination of market trends, whether during the COVID-19 pandemic or previous financial crises, one consistent lesson emerges: the markets recover. The resilience of the S&P 500 and the upward trend over time emphasize the value of maintaining a long-term perspective and resisting knee-jerk reactions to market lows. Staying invested, even during volatile periods, has historically resulted in growth and the compounding effect of reinvested dividends.

Building a Resilient Portfolio

Diversification

Putting all your eggs in one basket can lead to significant losses. A diversified portfolio containing a wide range of both domestic and international stocks and bonds can minimize risks and create opportunities in various market conditions.

Risk Management

Invest according to your risk tolerance. A balanced approach can aid in both growth and capital preservation.

Rebalancing

Aligning your portfolio with investment goals is an ongoing process. Regular adjustments keep your strategy on track.

Dividend Investing

As discussed earlier, dividends provide a steady income stream and act as a cushion during market downturns. Reinvesting dividends compounds growth over time.

Avoid Market Timing

Our analysis of market timing underlines its unpredictable nature. Consistent, strategic investing, unswayed by short-term market movements, usually leads to long-term success.

In Conclusion

Investing is a landscape often clouded by misinformation, false promises, and short-sighted tactics. History shows us how to invest – buy and hold and stay the course – and any investor can do that themselves without professional advice. However, a comprehensive financial plan is so much more than buying and holding. After all, you’ll eventually need those funds at some point, whether for retirement or some other strategic financial situation, such as buying a home.

That’s why a skilled financial advisor is so important – they can weave together the various threads of your financial life, such as portfolio rebalancing, withdrawal strategies, estate planning, insurance considerations, tax implications, and alternative investments. And this is something your average investor simply cannot accomplish.

Ready to build a resilient and tailored investment plan? Contact our team today by clicking the button below and take control of your financial future.