Inflation Steady, Economy Resilient

Inflation edged slightly higher and remains above the Fed’s 2% target, with the PCE index at 2.8% for both headline and core readings, in line with expectations. Consumer spending stayed strong, rising 0.5% in both October and November, while income growth was modest and savings dipped slightly. Economic data continues to show solid momentum, with GDP growing 4.4% in Q3 and jobless claims near two-year lows, signaling ongoing expansion despite a cooling labor market. Markets expect the Fed to hold rates steady next week, with limited additional cuts anticipated as policymakers balance persistent inflation and economic resilience.

Trump Floats Depreciation Tax Break for Homeowners

President Trump suggested allowing homeowners to claim depreciation deductions on personal residences, a tax benefit currently reserved for business and rental properties. While the idea aims to address housing affordability, it remains unclear how such a change would be implemented or whether it has support in Congress. Under current law, depreciation is tied to income-producing property and is later partially recaptured by the IRS upon sale. The proposal comes amid broader efforts to ease cost-of-living pressures, including actions targeting housing affordability and institutional ownership of single-family homes.

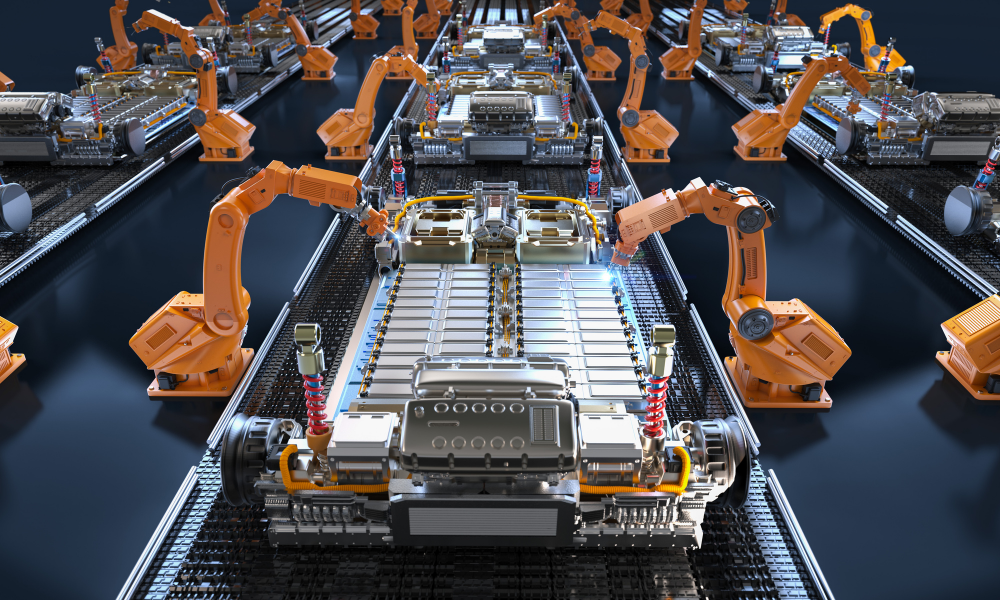

Automakers Turn to Energy Storage as EV Demand Slows

U.S. automakers are increasingly shifting into energy storage as EV sales cool and companies look to better utilize costly battery factories. Energy storage demand is rising due to data centers, electrification, and the need to balance intermittent renewable power, though the market’s near-term size remains uncertain. Tesla has found notable success in the space, while Ford and GM are investing heavily, repurposing factories and launching residential and grid-scale battery products. While the opportunity is supported by policy incentives and growing electricity needs, automakers face challenges from established competitors, workforce constraints, and the risk of oversupply if demand fails to materialize as expected.

As always, Base Wealth Management remains focused on aligning investment strategies with your long-term goals amid evolving market conditions.