Inflation Cools In April – Ahead of Tariff Impact

Inflation remained subdued in April, with the Fed’s preferred measure, the PCE price index, rising just 0.1% as new tariffs imposed by President Trump had not yet impacted consumer prices. Core inflation, excluding food and energy, also increased only 0.1%, while consumer spending slowed and the personal savings rate rose sharply. Personal income jumped 0.8%, but markets showed little reaction amid ongoing uncertainty over trade policy and monetary decisions. Trump’s broad 10% tariffs and recent legal battles over their legitimacy have raised concerns about potential inflation spikes later in the year.

Consumer Confidence Rose in May

Consumer confidence surged in May, with the Conference Board’s index jumping to 98.0 amid growing optimism over a U.S.-China trade truce. The rebound, which followed five months of decline, was largely driven by President Trump’s decision to halt severe tariffs on May 12. Sentiment around current conditions, future expectations, the stock market, and job prospects all improved, with Republicans showing the strongest gains in optimism. Despite lingering concerns about job availability, the overall outlook brightened across age, income, and political groups.

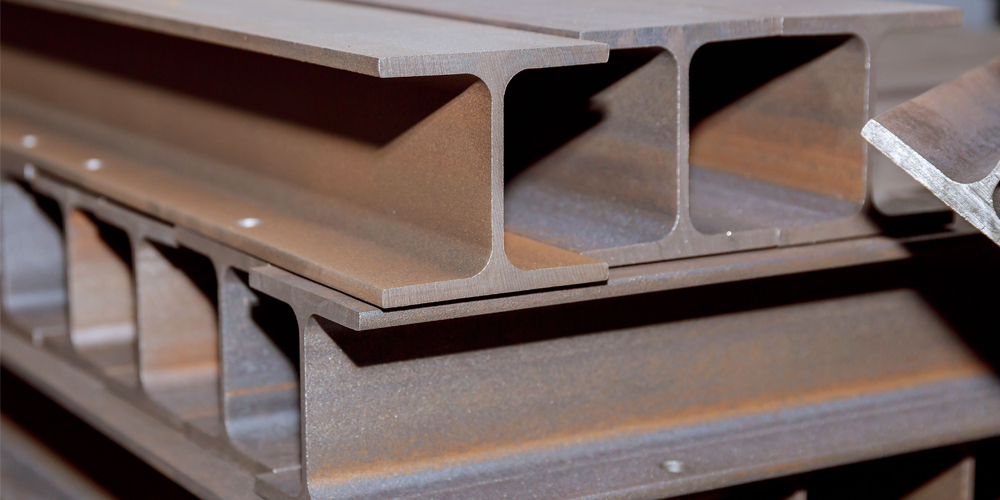

Trump To Increase Steel Tariffs – EU Responds with Countermeasures

President Trump announced he will double tariffs on steel imports to 50% starting June 4, aiming to further protect the U.S. steel industry. Speaking at U.S. Steel’s Irvin Works, he also touted a $14 billion “partnership” deal with Japan’s Nippon Steel, promising no layoffs, continued domestic operations, and a $5,000 bonus for workers. Despite calling it a partnership, the deal resembles a merger, with Nippon acquiring U.S. Steel but agreeing to U.S. control through a “golden share” and an American-led board. While officials claim the arrangement protects national security, union leaders remain wary of Nippon’s history and its potential impact on domestic jobs. The European Union strongly criticized President Trump’s decision to double steel tariffs to 50%, warning it jeopardizes efforts to reach a negotiated resolution to the trade war and threatens global economic stability. The EU signaled it is ready to reinstate and expand countermeasures as early as July 14 if no deal is reached. Canada and the United Steelworkers union also condemned the move, citing risks to jobs and industries reliant on steel and aluminum. Meanwhile, Trump’s broader tariff strategy faces legal uncertainty after a court ruling challenged his authority, though an appeals court has temporarily paused that decision.