Some investors have a great habit of selling low and buying high, letting emotions determine their financial decisions, at great cost to their portfolio and mental well-being.

A savvy investor knows that it’s always a great time to buy, for the numbers show that it really doesn’t matter when we buy – in the end, the investor will likely come out on top. Not by playing their cards right, but by sticking them close and not letting them go.

Buy, even when markets are at all-time highs? Yes, buy high. Buy low. Buy all the time.

The reason is, we can’t time the market. We can’t prove in which direction the market will move on any given day or time period. We just can’t. But what we can do is look back at investment opportunities, both taken and not taken, and determine that pulling money out leaves one open to missing the best days in the stock market. For each best day missed is a lost opportunity (and a costly one at that). Let’s crunch the numbers.

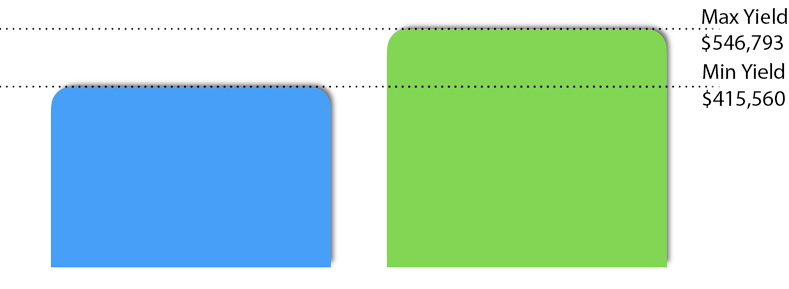

A 20-year annual $10,000 investment into the S&P 500 during its yearly market highs (meaning, you choose the worst day to invest and buy high), entering on 12/31/99, would have yielded you an annual return of 6.91 percent. Pretty great for being unlucky and buying high each and every year!

What if you were lucky and bought in at the low each year? Then you would have ended up with an annual return of 9.16 percent. Great numbers, any way you look at it. But let’s face it, you probably wouldn’t have been the luckiest or unluckiest investor over that time period, so your annual return would probably have been around 7.5 percent.

Investing $10k annually on either the worst possible market days (blue) or the best possible market days (green) still leads to strong returns.

Sources: Thomson Reuters and S&P 500 Index

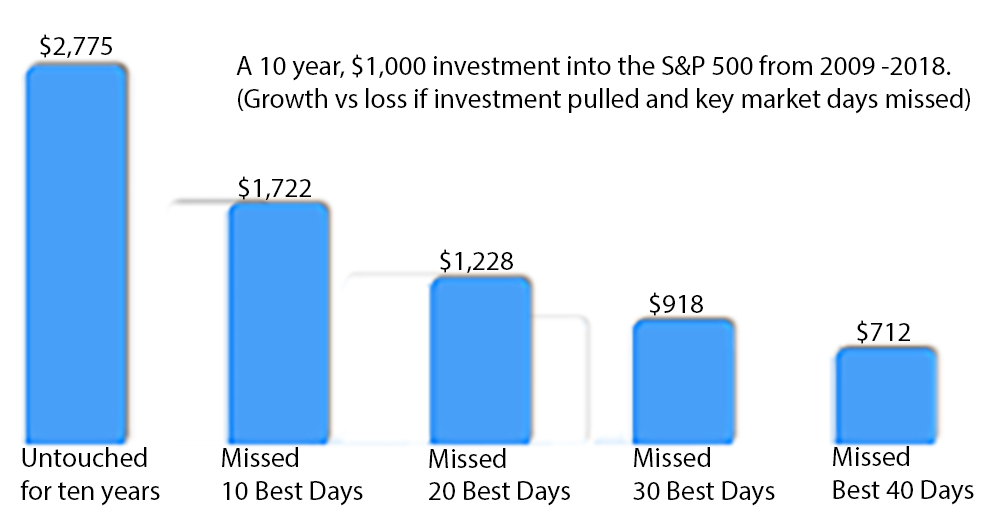

What would have happened if you had tried timing the market?

You could have (and surely would have) missed out on some of the best market days, those days when the market upticks really bring in a healthy bounty. Let’s look at a time of high volatility, when many panicked and pulled the rug out from their investments. A $1,000 S&P 500 investment put in on 1/1/09 and untouched for ten years would’ve landed you 2,775 bucks. Good job, you held through the worst of times and saw some great market days. If you had tried timing the market and missed ten of the best days on the market, your ten year investment would have yielded you $1,722. Not bad, but it gets exponentially worse. If you missed 20 days, then you would have ended up with $1,228. Now that’s a measly investment, but at least you gained.Here is where things get bleak.

If you were quite unlucky with your timing and missed 30 of the best market days, you would have LOST money. You’d be left with $918 dollars and a bad attitude. If you somehow missed 40 of the best days, then suddenly you’d be stuck with a miserable $712 dollars.

Source: S&P 500 Index